Celestia

An Investment Thesis

Executive Summary

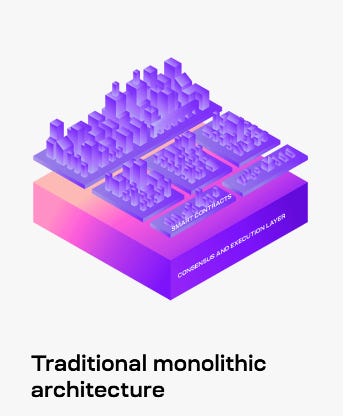

Celestia is unlike typical layer 1 blockchains. It aims to be the first modular blockchain, de-coupling the consensus and execution layer of traditional monolithic chains (all blockchains in existence).

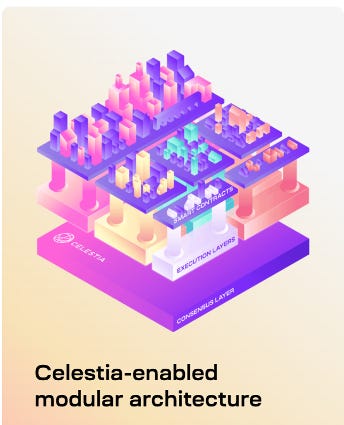

Celestia’s goal is to become the base layer for all chains. Other chains (L1 & L2) can use Celestia for scaling data availability (DA), whilst they instead focus on execution (I will explain this later). This also allows developers to create their own blockchain’s by only developing an execution layer and relying on Celestia to provide the DA and consensus layer.

As the DA & consensus layer, Celestia’s only job is to order transactions and verify that the data from the blocks being published is “available”. Use of Optimistic or ZK rollups allows users to validate if these transactions are in fact valid.

The separation of the core functions of a blockchain allow for better security, decentralisation and scale.

Key Terms throughout

Consensus – How users of the network agree on the state of the chain. Meaning the history of transactions that have occurred and in what order.

Execution – This is the interpretation of those transactions and how they impact the state of the chain.

Data availability – The availability of the data In the blocks for users to download it and verify all the transactions.

With this in mind, let’s now explain the difference between a Monolithic blockchain and a Modular blockchain.

Monolithic Blockchains

Every blockchain that has been built to date is a monolithic blockchain, meaning the consensus and state execution happen at the same time and are enforced by the same set of validators.

To check if a block is valid a monolithic blockchain needs to check two things:

Is there consensus?

Are all the transactions in the block valid?

A monolithic blockchain checks this by requiring every full node download the blocks data and execute every transaction. The problem with this is that it doesn’t scale and therefore we have seen high fees on layer 1’s and soon to be layer 2’s.

Furthermore, since the consensus and execution layer are bundled together, with smart contracts built on top, developers and smart contracts are bound by one execution environment. This greatly limits flexibility as developers must build dApps that are recognised and abide by the rules of the virtual machine in the execution layer.

Modular blockchains (Celestia)

As discussed, a modular blockchain separates the execution and consensus layers into more specialised components. The smart contracts are therefore hosted on the execution layer.

The consensus layer is what Celestia aims to be and is focused solely on data availability and consensus. Any other blockchain (L1 & L2) can be the execution layer, hosting smart contracts in their own virtual machine. This allows for plug-and-play blockchains to be built easily and quickly, allowing for optimised chains for specific use cases.

Celestia doesn’t require all full nodes to download block data to check if a block is valid, it modifies rule (2) and only requires all transactions are posted on-chain, even the invalid ones.

Celestia only job therefore is to check:

Is there consensus?

Is all the transaction data in the block posted on-chain? (data availability)

Optimistic or ZK rollups will then audit the validity of these transactions by using fraud proofs and validity proofs, respectively. The only thing they require to do this is data availability.

Scaling and Data Availability Sampling

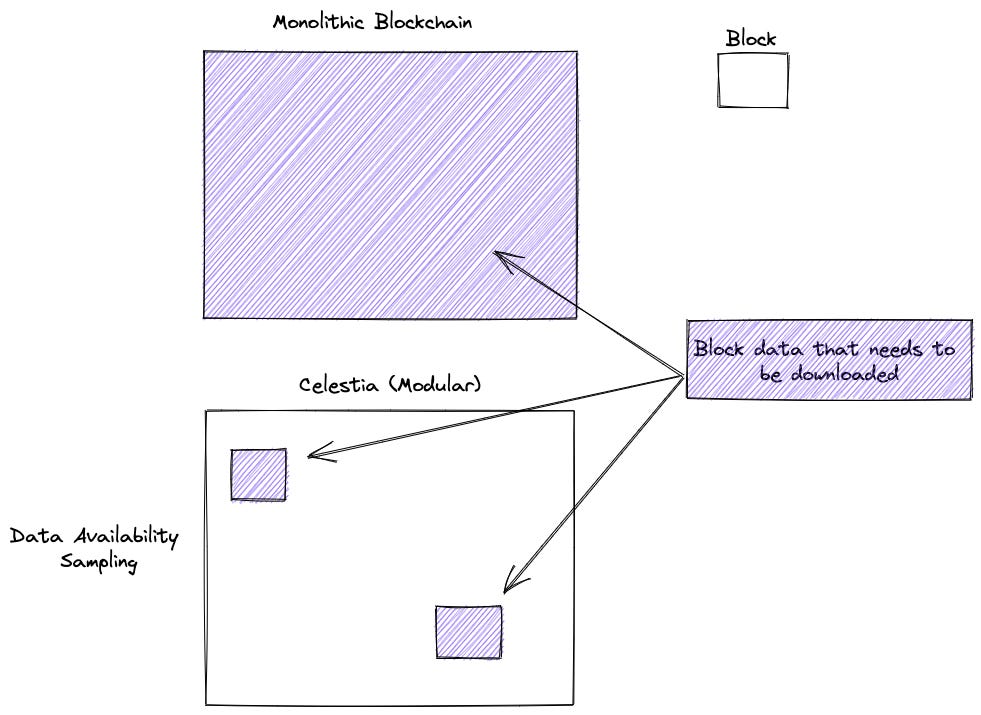

On Monolithic chains, individuals with a computer can (usually) run a full node and download block data to verify transactions. However, this is not scalable, as the more transactions that are processed, the larger the blocks and the more data that the full nodes need to download. This process therefore becomes increasingly resource intensive, requiring improved hardware (such as ASIC’s) to function. Thus, representing not just a massive scalability issue but also a decentralisation issue, since individuals will not be able to afford/have access to this expensive hardware.

Celestia has solved this scaling issue by allowing full nodes to just verify that all this data has been made available on-chain, no longer requiring the full download of all the block data. Celestia then use data availability sampling to probabilistically verify whether the blocks data is available without downloading all the data.

A full node can download a small sample from the block and verify if all the data is there by using Erasure coding. This is the same coding that allows a CD rom to play when it is scratched.

For example, in a monolithic chain you would need to download 10 Gigabytes of data to verify the block. On Celestia however, a full node could download just 100 Megabytes (not to scale) of that data from different samples of the block and be 99.99% sure that all the data is available.

Furthermore, the number of chunks of data that full nodes need to sample to verify data availability is irrespective of the block size. This means you can increase the block size and transactions per second without increasing the cost (and hardware requirements) to the end user to validate the chain. In fact, you can run data availability sampling on a mobile phone.

The one caveat is that the bigger the blocks, the more users need to run full nodes to download these chunks of data and probabilistically verify the data availability.

The Evolution of Blockchains

“Celestia is for decentralised apps, what cloud computing is for the traditional web” - Nick White, COO of Celestia Labs

The early web was defined by each website having its own physical server. This is akin to blockchains in their early stages, where you had individual blockchains for specific use cases such as Bitcoin, Namecoin and Litecoin.

The Developing web featured shared hosting server technology that allowed websites to shares servers. The websites in the phase were confined by the resources of the services and their programming environment. In 2014, Ethereum came along and was a general purpose blockchain where developers could easily build smart contracts, without building a whole new blockchain. Like shared servers, smart contracts must share resources of block space and use the Ethereum virtual machine (EVM).

The Modern web is now characterised by cloud computing. These are efficient and scalable data Centre's that allow websites to be run on their own virtual machines. Improving scalability and flexibility. Celestia can be thought of as a data centre that provides scalable and secure block space to deploy any kind of decentralised computer (using their own virtual machine). Again, this allow for unparalleled scalability and flexibility for dApps.

Token Utility and Tokenomics

There is currently no full information on the Celestia token. However, The COO, Nick White, talked on a podcast and confirmed that the Celestia token would be used to secure the Proof-of-Stake network and be used to pay for transaction fees on the network. This will include staking and delegating and also earning inflationary rewards for participation.

Just like ETH is used to pay for the use of block space on the Ethereum network, Celestia’s token will be used to pay for posting data on the blockchain and making it available. In my opinion this presents a great alignment of the project and the token. Value is accrued directly to the token; if there is demand for Celestia’s consensus and data availability layer as new blockchains are built on it, there is more demand for native token.

Furthermore, Celestia have announced they plan to implement a fee-burn mechanism similar to EIP-1559 in Ethereum. The burnt fees will offset new token issuance as Celestia gains adoption and depending on the demand for Celestia’s service, this could result in a deflationary supply.

The Celestia Labs Team

Celestia is being built by Celestia Labs. Celestia’s team has a track record of innovation, with deep experience in blockchain scaling from working on projects like Ethereum, Cosmos and Harmony. Here are a few projects and companies that the team have founded or worked on:

Now let’s have a look at the core team:

Mustafa Al-Bassam is the CEO of Celestia Labs. He wrote his PhD thesis on scaling Layer 1 blockchains with notable additions from Vitalik Buterin, the Co-Founder of Ethereum. Following his PhD he Co-Founded Chainspace, a scientific research company dedicated to scaling blockchains at the base layer. Chainspace was acquired by Facebook in 2019.

Ismail Khoffi is the CTO of Celestia Labs. He is a former senior engineer at Tendermint and the Interchain foundation. Khoffi built the first working version of the Tendermint light client in Rust.

John Adler is the CRO at Celestia Labs. He was the inventor of Optimistic Rollups and has previous experience as a scalability researcher at ConsenSys. Before joining Celestia he was the Co-Founder of Fuel Labs, an optimistic rollup solution built on the Ethereum network.

Nick White is the COO of Celestia Labs. He has a BS and MS from Stanford University in Electrical Engineering and has experience in Hong Kong, accelerating AI startups. White was also the Co-Founder of the Harmony protocol, a large, EVM compatible layer 1.

Tomasz Zdybał is a software engineer at Celestia labs. He has 10 years of professional experience as a software engineer, most notably working as a core software developer at the TRON foundation and Ethereum Classic Labs.

Investment Thesis

The Future is Modular

Traditional monolithic blockchains have many drawbacks due to the coupled nature of their execution and consensus layers. Celestia improves on these four elements: scalability, flexibility, sovereignty and costs. Let’s analyse each of them:

Scalability – As previously explained, Celestia improves scalability of blockchains greatly as full nodes no longer need to download the entire block to verify transactions. Celestia’s data availability sampling design allows its blockchain to scale with the number of nodes, meaning a theoretically infinite number of transactions per second could be processed. I believe the future of blockchain scaling is modular.

Flexibility – Building on all current blockchains (Monolithic) requires the developer designing their application or smart contract in the virtual machine that chain uses. For example, building on the Ethereum network requires you building in the EVM. As a result, developers are limited in design capabilities as they must be recognised by the EVM. Celestia allows developers to build in any execution environment and utilise the Celestia DA layer for consensus. This allows for much great flexibility when designing blockchains and dApps.

Sovereignty - Building on monolithic chains implicitly requires the app or smart contract to be bound by the social consensus of the blockchain. For example, the Ethereum community decided to upgrade the EVM but in doing so all the smart contracts of a popular DAO broke. Furthermore, if there is a hack on the Ethereum network and your application is exploited, you have to convince the entire Ethereum community to fork the chain and reorganise it. This is now an almost impossible task and it leads to large exploits like the 120,000 ($400 million) Wormhole exploit just the other day. Celestia solves this problem by allowing each chain/application to remain sovereign, meaning if there was a hack, that chains community could, independently of Celestia, vote to re-org the chain.

Costs – To set up and run a blockchain, founders face huge technical and legal overheads as they try to create an entirely new blockchain. This includes bootstrapping their network with validators and stakers in order to achieve a stable consensus and it leaves just the largest chains with the most validators being secure. Celestia looks to dramatically reduce this cost and effort as new blockchains can plug-and-play into the Celestia consensus layer, leaving them to focus only on their execution.

Potential Bullish Tokenomics

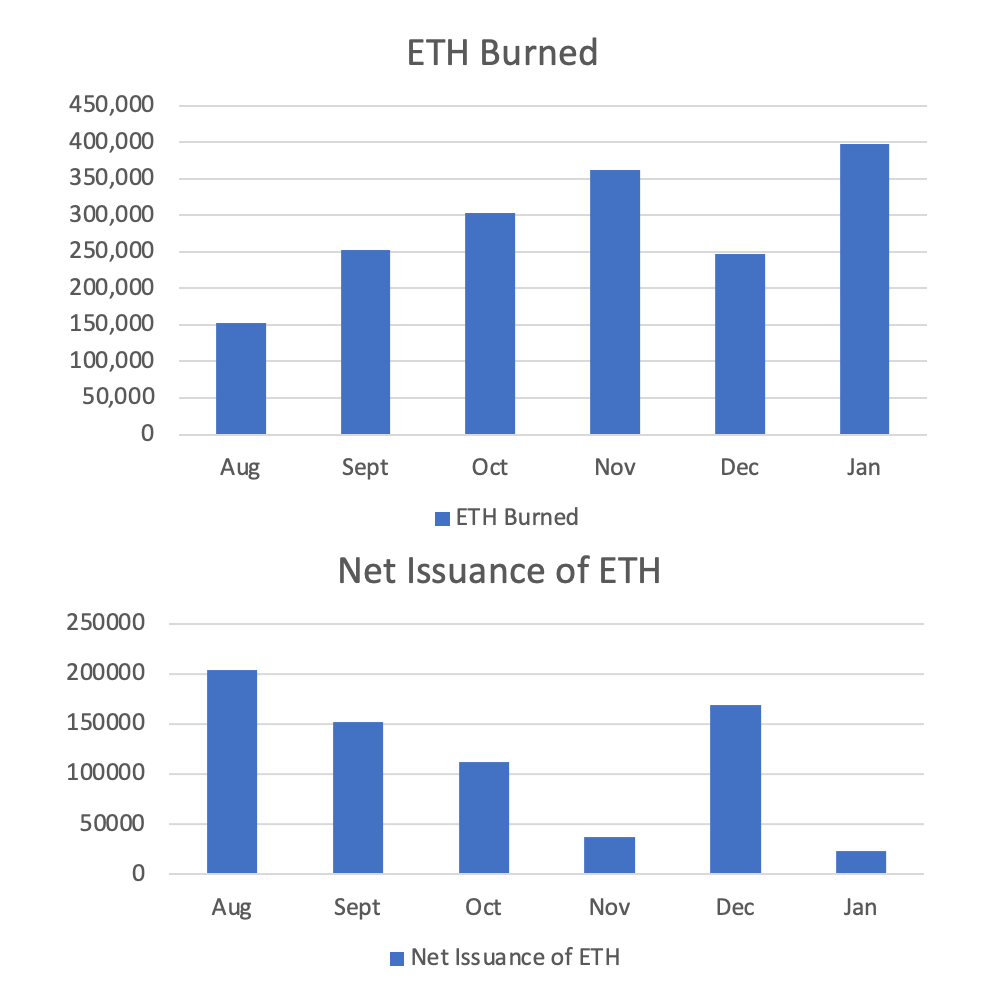

From what we have learned about Celestia’s tokenomics, they accrue value to the token very well, as demand for the consensus layer of Celestia will directly result in buying pressure on the token. Furthermore, they plan to implement a fee-burn mechanism similar to EIP-1559 in Ethereum. This will mean burnt fees offset new token issuance as Celestia gains adoption. This fee burn feature presents a bullish catalyst for Celestia as it gains adoption and demand.

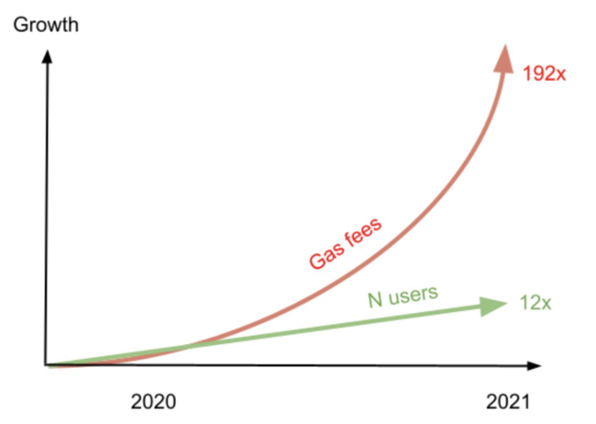

If we examine EIP-1559 for comparison, we can see why:

Since EIP-1559 launched over 1,828,044 ETH ($5.37 billion) has been burned. This is due to the high demand for block space on Ethereum, leading to the burning of high base fees. There is so much demand in fact that Ethereum supply has become deflationary for short periods of time.

If we assume that the demand for Celestia’s consensus layer will be high due to its superior properties, we will see a large token burn. The burn will result in a reduction in net issuance of Celestia’s token and may even lead to a deflationary supply schedule.

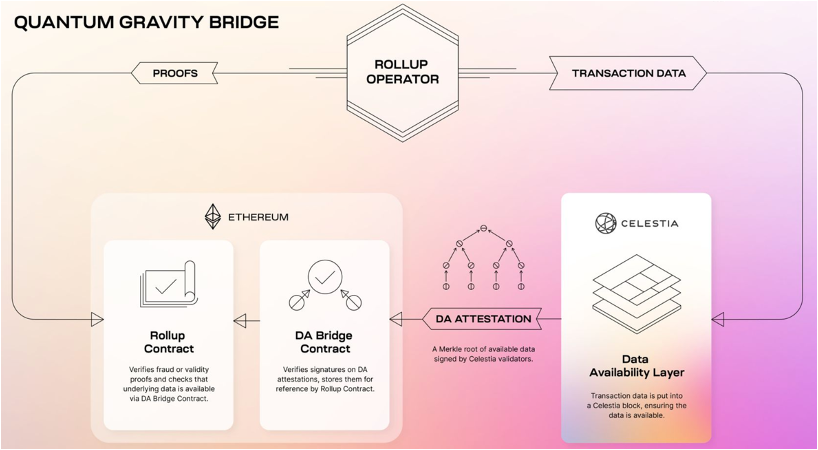

Celestiums

On the 8th of February, Celestia released plans for a new project that helps scale Ethereum Layer 2’s (L2). As transaction volumes on L2’s rise we will see a rise in fees, similar to what we saw on the Ethereum mainchain. Celestia has released plans to help scale Ethereum L2’s by using what they call Celestiums.

A Celestium is any Ethereum L2 chain that uses Celestia for data availability, but uses Ethereum for settlement and dispute resolution. Celestiums will provide high throughput data availability for Ethereum L2s, with a higher level of security than other off-chain data availability techniques.

Celestia’s input in scaling Ethereum L2’s will be a bullish catalyst for the project. The L2’s will utilise Celestia’s DA layer and in doing so, will demand Celestia’s native token. Furthermore, the burn mechanics of the token will further drive this imbalance in demand and supply.

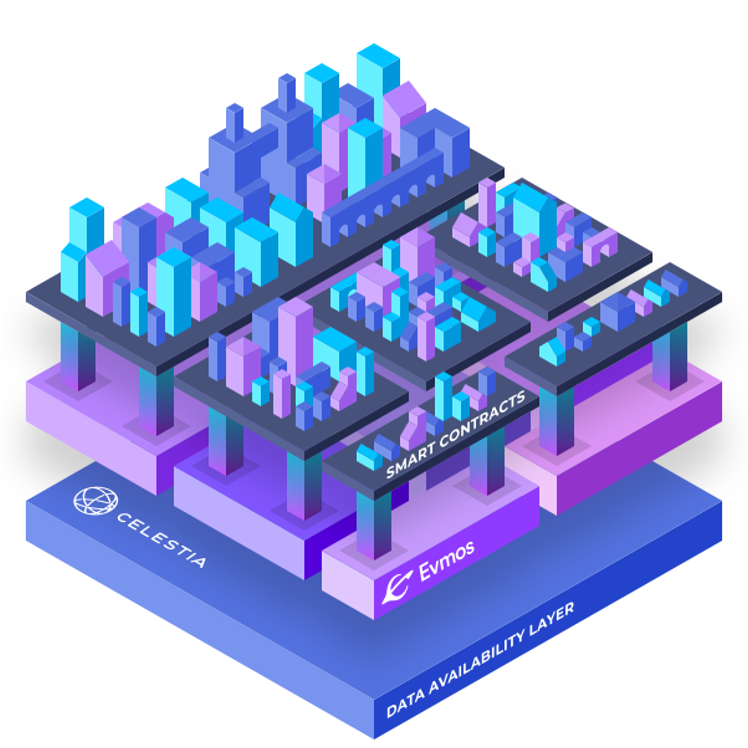

Cevmos

Celestia is partnering with Evmos to build a settlement layer for EVM rollups called Cevmos. The settlement chain will be implemented as a Celestia rollup using Optimint instead of the Tendermint Core consensus engine that is used on existing Cosmos chains.

The partnership of Celestia and Evmos will create great network effects for both projects and allow Celestia to be utilised as the data availability layer for the main bridge between the Ethereum ecosystem and the Sosmos ecosystem.

The integration of Celestia DA layer for Evmos will be a bullish catalyst for both EVMOS and Celestia’s token and I believe we could see a substantial re-pricing.

Competitors

Since Celestia aims to be the first modular blockchain, there aren’t many competitors yet. There are a few early stage DA chains but I believe Celestia is unique in its focus on user experience and ease of use, currently, the DA competitors do not allow for hosting of sovereign blockchains as simply as Celestia aims to. A couple of the solutions also make sacrifices in decentralisation and security. Let’s have a quick look at the current DA projects coming to the market:

Avail - a general-purpose, scalable data availability-focused blockchain targeted for standalone chains, sidechains, and off-chain scaling solutions. Avail provides data availability by using erasure coding, much the same as Celestia. The team are currently testing their Devnet. I believe Avail is currently the closest competitor to Celestia, however, it is less decentralised.

Zk Porter - Zk porter from zkSync aims to scale Ethereum by being the off-chain data availability layer. The data availability is ensured by the zkSync Proof-of-Stake network. This means however, the data availability layer does not inherit the same security as the Ethereum Mainnet and is thus more susceptible to attacks.

Starkware - Starkware are developing StarkEx, a self-custodial scalability engine. StarkEx use off-chain Data availability to record transactions. They have formed the Data Availability Committee (DAC). The DAC members are entrusted with keeping copies of the off-chain data and placing them in the public domain in case of emergency. Celestia is unique in that it provides this data availability in a much more decentralised way, not relying on an small, elected committee.

Potential Risks

Some applications need their own Consensus layer to perform specific actions. For example, Osmosis is a DEX in the Cosmos ecosystem and it aims to prevent MEV (link to an article I wrote on “what is MEV”) by obfuscating transactions before validating them. A risk is that certain applications couldn’t be built on Celestia due to the decoupled nature of the execution and consensus layer.

Celestia cannot bootstrap their protocol – As we have discussed earlier, the transactions per second on the chain scales with the number of full nodes. If Celestia cannot incentivise or bootstrap nodes onto the network, the chain will not be able to scale

Heightened execution risk – Celestia is attempting to be the first modular blockchain and with that comes a high risk of failure due to the uncertainties of moving from zero to one.

Competition – Monolithic blockchains may be able to scale to the required capacity for mass adoption, without becoming modular. The use of data sharding, rollups and application specific chains may mean Celestia is not needed.

Exploits – Becoming the first modular blockchain will bring with it a high risk of exploits as we don’t yet know what we don’t know.

Shoutout to Knarb, he wrote a great article on Celestia that can be found here:

Any mistakes or feedback would be greatly appreciated!

I'm curious about your take on Subspace - subspace.network?

Great article, really like your style