If you liked my work and would like to trade Perps & Complete swaps on GMX with Zero slippage, click here:

Project Overview

GMX is a decentralised perpetual and spot exchange that allows you to trade assets on-chain, without an account, KYC, geographic restrictions or high centralised exchange fees.

The exchange initially launched as Gambit Financial on the Binance smart chain (BSC) but later rebranded to GMX when it launched on Arbitrum. The exchange now operates on both the Avalanche network and on Arbitrum, a layer 2 scaling solution built on Ethereum, and has plans to expand to new chains in the future.

Users can long or short assets in the GLP pool, on up to 30x leverage and complete swaps. The pool is composed of high quality crypto-assets, which vary depending on network.

Since it’s launch on Arbitrum (31.08.21), GMX has processed a total volume of $16,870,364,343. On the 6th of January 2022, GMX launched on the Avalanche exchange and has since processed a total volume of $5,090,570,247, bringing the cumulative total volume to over $21.5 Billion.

Project Description

Protocol Mechanics

Traders on the GMX platform on the Arbitrum network can perform asset swaps on ETH, BTC, LINK and UNI and a variety of stable coins. They can also leverage trade these assets in both directions by utilising the assets in the pool.

When entering a long on Bitcoin for example, a trader is ‘renting out’ the upside in Bitcoin, from the Arbitrum GLP pool.

When entering a short on Bitcoin, a trader is ‘renting out’ the upside of the Stablecoins versus Bitcoin, from the Arbitrum GLP pool.

Traders on the GMX platform on the Avalanche network can perform asset swaps on ETH, BTC and AVAX and a variety of stable coins. They can also leverage trade these assets in both directions by utilising the assets in the pool.

When entering a long on Bitcoin for example, a trader is ‘renting out’ the upside in Bitcoin, from the Avalanche GLP pool.

When entering a short on Bitcoin, a trader is ‘renting out’ the upside of the Stablecoins versus Bitcoin, from the Avalanche GLP pool.

GLP Pool

The GLP pool is a multi-asset pool that supports trading and allows users to long/short and perform swaps. This pool earns liquidity provider (LP) fees from market making, swap fees and leverage trading and these fees are distributed back to both GMX and GLP holders.

LP’s can ‘mint’ GLP tokens, which represent shares in the GLP pool, by deploying any of the index assets to the pool. They can redeem any index asset by burning their GLP holdings. The fees associated with buying GLP vary depending on which of the index assets are currently underweight/overweight. If any index is underweight the fees for minting GLP by depositing this asset is lower and hence incentivised.

The token weights in the pool are adjusted to help hedge the holders of GLP against the open positions traders have. So, if a large number of traders are long Bitcoin on the Arbitrum exchange, the GLP pool would have a higher Bitcoin weight and vice versa with stable coins if a large proportion are short.

Instead of the standard Automated Market Maker model (AMM) (x*y=k), GMX uses the GLP pool in combination with dynamic aggregated oracle price feeds provided by Chainlink (sourced from Binance & FTX) to determine the ‘true price’ of an asset. This allows GMX to achieve the true price of an asset with far less liquidity and means trades can be executed with zero slippage. Furthermore, LP’s are protected against impermanent loss as the traditional AMM model isn’t utilised.

The value of the GLP token is determined by the changing value of the index tokens inside of it, making it in a way, a diversified index of high quality crypto assets. In fact, GMX’s vision for GLP is to be “ a diversified index of top and upcoming cryptocurrencies all being used in a highly capital-efficient way while generating yield for holders”.

The GLP pool is essentially a liquidity pool that acts as the counterparty to traders on the GMX exchange. This means that if traders on GMX make a profit, GLP holders make a loss and vice versa.

Analysis of the cumulative Profit and Loss statement of traders on the GMX Arbitrum exchange shows that traders have lost money and thus GLP holders have benefitted.

Fees and Revenue Generation

The GMX protocol generates revenue by charging fees on the opening and closing of trades and also a “borrow fee” that is deducted every hour a leveraged position is open.

There is a trading fee of 0.1% of your position size when incurred when opening a position and closing a position. The borrow fee is the fee that is paid to the counter-party (GLP pool) of your trade at the start of every hour. This fee varies based on utilisation of assets in the GLP pool and is calculated as follows:

The Fees generated by the exchange are distributed entirely back to GMX and GLP holders. 70% of these platform fees will be distributed to GLP holders and 30% of them will distributed to staked GMX holders. Staked GMX holders receive 30% of the fees generated from both Arbitrum and Avalanche exchange.

However, since the GLP token is unique on each of these networks, holders of the Arbitrum GLP token will receive 70% of the GMX (Arbitrum) platform fees in ETH and holders of the Avalanche GLP token will receive 70% of the GMX (Avalanche) platform fees in AVAX.

Oracle Pricing and Trade Execution

GMX’s dual use of the GLP pool as the counterparty to traders and the oracle pricing system represents a huge innovation in the execution of trades. Firstly, trades are executed with zero slippage/ market impact as the traditional Automated market maker (AMM)/ Order book model is not used. This also represents an innovation for LPs as they are not subjected to Impermanent loss due to the oracle pricing system (not subjecting the LPs to the cost of price discovery via arbitrage).

Furthermore, the aggregated oracle pricing system GMX uses pulls price feeds directly from Binance and FTX. By aggregating these feeds, there is a reduction in the risk of liquidation from temporary wicks. Looking at the intraday wicks on the December 4th Bitcoin sell-off, we can see the GMX wick bottomed out 3.94% higher than FTX and 3.45% higher than Binance.

The dual use of capital and the oracle pricing system also enables the GLP to be one of the most efficient pools in the entire digital asset space. More on this later.

Industry Overview

Spot and Perpetual trades accounted for almost 95% of total trading volume in 2021. Both types of trading saw large increases in volume as well, with volume growing by 130% and 498%, respectively. This puts the total spot volume for 2021 at $49 trillion, whilst the total perpetual volume came in at $57 trillion.

We also saw a significant transition from Centralised exchange (CEX) trading to DEX trading, with the top 10 spot DEX’s increasing their quarterly volume by 441.92% from Q1 2021 to 2021 Q4. The top 10 DEX’s now make up 9.05% of all trading volume, up from just 1.67% in Q1 2021.

The total DEX perpetual volume market share also increased from almost 0% to just less than 3% (dYdX made up 2.22% of the entire perpetual exchange volume in Q4 of 2021).

The main trends for 2021 were the increase in both DEX spot and perp market share and I believe there are a few reasons for this. Firstly, the user experience has improved greatly, with improvements in gas fees due to the rise of alt L1’s and L2 scaling solutions. Another large reason traders may be favouring DEX’s is due to regulatory pressures on CEX’s leading to reductions in the leverage offered and the products offered.

2022 looks set for the continued growth of DEX trading and specifically DEX Perp trading. GMX could be a major beneficiary of this trend and as such GMX and GLP holders could greatly benefit from the rewards that will be distributed to holders.

Spot DEX

Looking at the Ethereum monthly DEX volume we can see that volume has been steadily increasing since early 2020. This trend suggests DeFi has found a real product-market fit and as such DEX volume has been booming.

GMX, aiming to be both a spot and perpetual exchange fits into both the DEX sub-sector and the derivative platform sub-sector of DeFi.

This continued, high DEX volume is a positive sign, if GMX can continue to attract users they could be a major beneficiary from this trend.

Team, Investors and Partnerships

In true Web 3.0 fashion, the GMX team is anonymous. I got in touch with the lead developer (known as X) and the structure of the team is as follows (names are telegram names):

4 Developers - xdev_10, gdev8317, xhiroz, vipineth

1 Designer - anonymous - xhiroz manages him

3 Marketing, Business development & partnerships – Coinflipcanada, puroscohiba, bagggDad

3 community managers – y4cards, supersonicsines

Given the anonymous nature of the team, it is not possible to assess the credibility of team members by traditional methods, such as recognised qualifications and experience. The next best thing is to assess the team’s ability to ship products and features.

Additionally there is no official list of members for each role. However through Medium articles, discord channels, GitHub repositories and communication with the team, we can see the work that the team has done.

A full team analysis can be found here in my full research report:

Investors

GMX had zero VC fundraising. The fundraise for Gambit and XVIX were public community raises and both of these projects had their tokens and liquidity migrated to GMX. VC’s and notable investors have therfore had to buy from the open market. Performing both on-chain analysis and from analysis of the GMX telegram chat we can discover a few things:

Blocktower has built a substantial position in GMX, buying over 2400 ETH worth of GMX in the open market. They currently own 336,478 GMX ($ 8,314,371), which is staked. Their wallet can be found here.

Ben Simon from Spark capital (previously Mechanism Capital) is in the GMX telegram chat and has contributed to getting GMX listed on certain platforms. He is also speaking about GMX at an upcoming conference. It is unclear whether Ben personally, or Spark/Mechanism are invested.

Flood Capital (Duncan Reucassel and co) are advisors for GMX and are rumoured to have built a sizeable position in GMX. Although we don’t know for sure, it is rumoured they are a top 10 holder of GMX. Duncan works in research for Delphi digital.

0xMessi – Social media influencer with 185,000 followers. He also built the gmxstats.com site.

Partnerships

Olympus

GMX has partnered with Olympus to sell GMX WETH bonds. 50% of the funds raised from the Olympus bonds, will be used to buyback and burn GMX as per the price floor fund. The other 50% raised will fund GMX marketing.

Dopex

GMX has partnered with Dopex, which is a decentralised options exchange. On Dopex, users can now purchase decentralised call and put options for GMX.

Aggregator Partnerships

Wardenswap, BreederDAO and YieldYak have integrated GMX as a route in their aggregator. GMX has since since routed >35% of the total volume traded in USD on YieldYak, beating out Platypus finance, Curve, Sushiswap and Traderjoe.

On-ramp and interoperability

Banxa is a fiat on-ramp platform that has partnered with GMX so users can directly convert fiat into ETH on Arbitrum, in order to buy GMX. Synapse is a multi-chain bridge that allows users to bridge their assets to both Arbitrum and Avalanche. They have integrated GMX so users can transfer their GMX from Avalanche to Arbitrum easily.

Exchanges

GMX is currently listed on Uniswap, TraderJoe, Hotbit, BKEX and AJAX.

Tracking applications

FTX app, 0xtracker, Coingecko, Defi llama, Coinmarketcap, Debank, Nomics Finance, GMX analytics, Zapper, Tokenterminal. All of these applications aim to track the price or statistics of the GMX token and platform.

Value Proposition for GMX

The need for a fully decentralised DEX for both Spot swap and Perpetual futures is becoming evident with the regulatory concerns surrounding CEX trading. A non-KYC exchange that is completely on-chain will allow the thriving Perp market to continue being the main source of liquidity to the digital asset ecosystem in case of CEX regulations.

The future is that of a multi-chain one. Different blockchains have positioned themselves at different positions along the blockchain trilemma scale and in doing so each chain will excel at certain use cases and underperform at others. GMX is chain agnostic and plans to expand to new chains and become the leading spot and perp DEX there.

GMX has a sleek UI without the need to KYC or even create an account. Moreover, the use of the GLP pool and price feeds provided from Oracles, enables trades to be executed with no price impact. The resultant effect is a great user experience when trading both Spot and Perpetual markets.

Roadmap and Scalability

The future for GMX is bright, with the proliferation to new chains and the adding of new tradable assets, GMX looks set to increase volume and fee generation.

An unknown is the plans for “X4”, which Xdev describes as a new type of AMM that will allow for the invention of new DeFi products and protocols.

Scalability and Growth

GMX, being chain agnostic, has plans to scale horizontally by deploying their contracts onto more chains and becoming a multi-chain Spot and Perp exchange. With the rise of alt-L1’s in 2021, there are plenty of chains to expand to with a large user base and GMX can instantly tap into this base on deployment. The focus will be on low transaction fee chains, that have high throughput.

GMX plans to scale vertically by continuing to increase market share on both Arbitrum and Avalanche. I reached out to a team member and they said the main priority right now is “to consolidate current work on Avax and Arbitrum”. One initiative the GMX team has voted on is the introduction of a referral program, similar to FTX and Binance’s referral programs. 10,000 esGMX per month of the marketing and floor price fund allocation is going to be dedicated to rewarding the referrers.

I believe GMX will also scale with the base chains they are already on. As mentioned, we are seeing high network adoption rates of both the Arbitrum and Avalanche chains and if these chains continue to grow, GMX will benefit.

Furthermore, the trend is firmly in the favour of DEX trades vs CEX trades, as DEX’s increased their market share of total trading by 441% in 2021. I expect this trend to continue for the foreseeable future and as such GMX will scale nicely.

Token Utility and Tokenomics

The GMX token is the platform’s utility and governance token and staking the token unlocks a few benefits. The GMX token will be used to vote on governance and determine future rules and goals of the protocol, such as esGMX emissions.

Staked GMX receives three rewards:

Escrowed GMX

Multiplier Points

ETH rewards – 30% of platform fees generated are distributed to staked GMX holders in ETH

These rewards provide long-term incentives for GMX holders to stake their coins and compound rewards.

GMX have also talked about the possibility of GMX holders receiving fees discounts on trading, depending on how much GMX they hold. See here.

Overview

Supply

The Tokenomics of a project are all the factors that describe the mechanics of how an asset works, including the incentives, psychological or behavioural forces that affect the value of an asset. Ultimately, the Tokenomics of a project can be separated into the supply and demand. Let’s first look at supply:

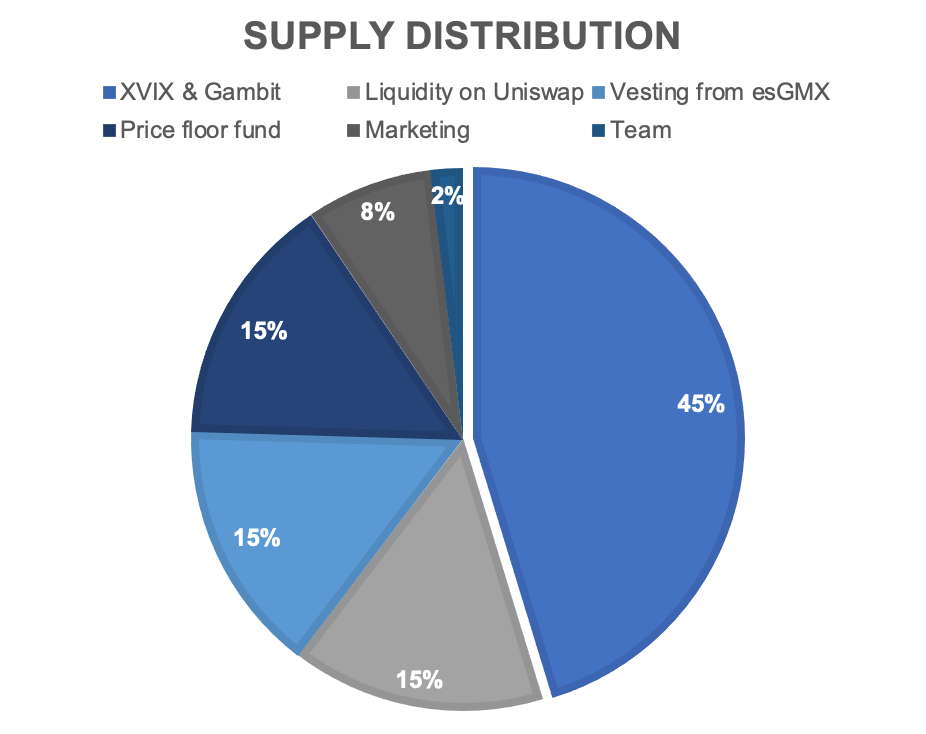

*GMX has a total supply of 13.25 million of which 7.37 million are circulating (55.6%). This maximum supply can be increased via a DAO vote from GMX holders. This option will only be used “if more products are launched and liquidity mining is required”. The supply distribution will look like this:

2 million GMX paired with ETH for liquidity on Uniswap.

2 million GMX reserved for vesting from Escrowed GMX rewards (may never happen)

2 million GMX tokens to be managed by the floor price fund. Yet to be minted

1 million GMX tokens reserved for marketing, partnerships and community developers.

250,000 GMX tokens distributed to the team linearly over 2 years

Escrowed GMX (esGMX)

Staked GMX holders are entitled to receive Escrowed GMX (esGMX) as a reward and this esGMX can be used in two ways:

Staked for rewards similar to normal GMX

Vested to become normal GMX tokens over a period of 1 year

Staked

esGMX can be staked immediately, earning the holder exactly the same rewards as normal staked GMX – more esGMX, multiplier points and ETH/AVAX rewards from platform fees.

Vested

esGMX can be vested to become normal GMX. To vest your esGMX, you are required to lock the average GMX/GLP that earned you that esGMX in a vault. Whilst in this vault the GMX/GLP cannot be sold but does still accrue rewards. Vesting esGMX then unlocks linearly and takes one year to unlock fully, with GMX or fractions of GMX being distributed to you every second.

The locked GMX/GLP in the vault can always be withdrawn but this will stop any further vesting of esGMX

Current Distribution of esGMX

100,000 esGMX tokens per month to GMX stakers

100,000 esGMX tokens per month to GLP holders on Arbitrum

50,000 esGMX tokens per month to GLP holders on Avalanche from Jan 2022 - Mar 2022

25,000 esGMX tokens per month to GLP holders on Avalanche from Apr 2022 - Dec 2022

Multiplier Points

The second reward GMX holders are entitled to is Multiplier points. Multiplier points are a way to reward long term holders without inflation. Staked GMX receives multiplier points every second at a fixed rate of 100% APR.

These multiplier points can then be staked, allowing the holder to accrue protocol fee rewards. Each multiplier point is entitled to the same amount of ETH/AVAX as a normal GMX token.

Unstaking GMX or esGMX will mean a proportional amount of multiplier points are burnt. "For example, if 1000 GMX is staked and 500 Multiplier Points have been earned so far, then unstaking 300 GMX would burn 150 (0.3 * 500) Multiplier Points”.

This mechanism incentivises holders to stake their GMX for long periods of time as the only way to acquire multiplier point is through time. Furthermore, the GMX team has hinted (“the specifics of these benefits will be released at a later time”) at future rewards being distributed based on these points as they are a good proxy for a power/long-term user of the protocol.

Supply Emissions

The current scheduled emissions are from the esGMX allotment, distributed to GMX stakes and GLP holders on both Arbitrum and Avalanche. However, this GMX is not liquid as it must be locked for a year with the average amount of GMX/GLP that earned the holder that esGMX. With the current esGMX emissions, we will reach the 2,000,000 cap in December of 2022. However, this esGMX may never turn into GMX as people leave the project/ don’t vest their rewards.

The rest of the GMX emissions are introduced on an ad-hoc basis to fill the budgets introduced on slide 34. The GMX team will, for example, use the GMX liquidity budget to add liquidity when needed and not on a set schedule.

Due to the ad hoc nature of these emissions we are unable to get an exact supply emissions schedule, however, by using the information on esGMX vesting, the linear team unlock and the allocated budgets of GMX, the inflation of GMX looks to be low.

Token Demand

Next we will look at demand for the GMX token. We will analyse the return on investment and the project mechanics to better understand why this token will be in high demand.

The staking of the GMX token entitles users to earn a 30% share of the protocol revenue, distributed in ETH. This currently represents a 27.41% APR (9.42 WETH APR, 17.99 esGMX APR), however, this esGMX APR should be discounted as it is not immediately liquid. This return on investment represents a large opportunity for long term holders to generate additional returns and as such 82.25% of the total supply is staked.

Price Floor Fund

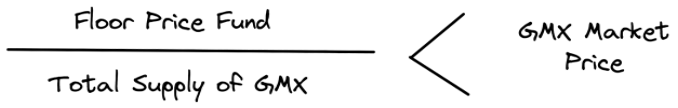

The next source of demand for the GMX comes from the price floor fund. 2 million GMX have been allocated to be managed by the price floor fund and are yet to be minted. The idea is that the price floor fund will help ensure liquidity in the GLP pools and provide reliable rewards for staked GMX, this is because it is protocol owned liquidity.

As the price floor fund grows, due to accumulation of fees from the liquidity provided in the GLP and from 50% of the funds from the Olympus bonds, it can be used to buyback and burn GMX if:

This will lead to a minimum price for GMX in terms of ETH and GLP. Since the price floor fund currently has $3,938,827 and the GMX supply is 7,373,371. The price floor for GMX is $0.53.

Investment Thesis

DEX Aggregator Catalyst

GMX is both a decentralised derivative platform and spot platform. The elegant design of the GLP pool, a multi-asset liquidity pool, in combination with the oracle pricing method allows for digital asset swaps to be completed with no market impact, akin to an OTC trade. This trade execution design was so efficient on the BSC chain (with Gambit), that at its peak Gambit was handling roughly 20% of all 1inch exchange’s (aggregator) traffic with just under $2.5 million in liquidity and only a few assets swappable. Furthermore, GMX was added as a new route on YieldYak (21.01.22) and has since routed >35% of the total volume in USD, beating Platypus finance, Curve, Sushiswap and Traderjoe.

A huge catalyst for GMX would be its integration into aggregators such as Matcha, Paraswap and 1inch (on Arbitrum and Avalanche). Since GMX is one of the most liquid places to trade assets in the GLP pool, an aggregator integration would result in a large share of the volume from trading these assets to be routed through GMX. This in turn would increase the number of users of GMX and the fees generated and distributed to GMX stakers.

Certain trade sizes would almost always be routed through GMX instead of through the typical AMM models of Uniswap, Sushiswap and Curve and this represents a large vertical that GMX can exploit to gain market share. Taking a look at trade execution on the Avalanche network, we can see that GMX already offers the best execution of USDC to AVAX, with only $75,146,457 in the GLP pool.

The Market Opportunity and DEX Adoption

The perpetual futures (Perps) market is the main source of liquidity and trading volume in the digital asset space and GMX is positioned well to serve a proportion of this demand for perps. In 2021, perp volume in the digital asset space was around $57 trillion, accounting for 52.8% of all trading volume. The perp market was also witnessed the largest growth of all the derivatives, growing by an estimated 358% in comparison to derivative trading volumes.

Analysis of the decentralised perp exchange volume vs the centralised perp volume shows there is a clear trend toward DeFi perps, having grown from just 2% of market share in Sept 2021 to around 5.4% at the start of November 2021. This trend looks set to continue in 2022 as advances in layer 2 solutions and faster chains have made perp trades viable. Moreover, another key catalyst for further growth of DeFi perps is regulator concerns surrounding CEX’s.

Therefore, the total addressable market for GMX perp’s is staggering and if they could capture just a small percentage of total perp volume, the GMX token will accrue massive value to holders, through revenue share (more on this in the valuation section – starting on page 45 ). With the expansion of GMX to multiple chains, the addition of new assets to the GLP pool (to become tradeable) and the continued growth of the protocol on Arbitrum and Avalanche, it is likely that volume processed by the platform will continue to increase.

Fee Generation and Chain Expansion

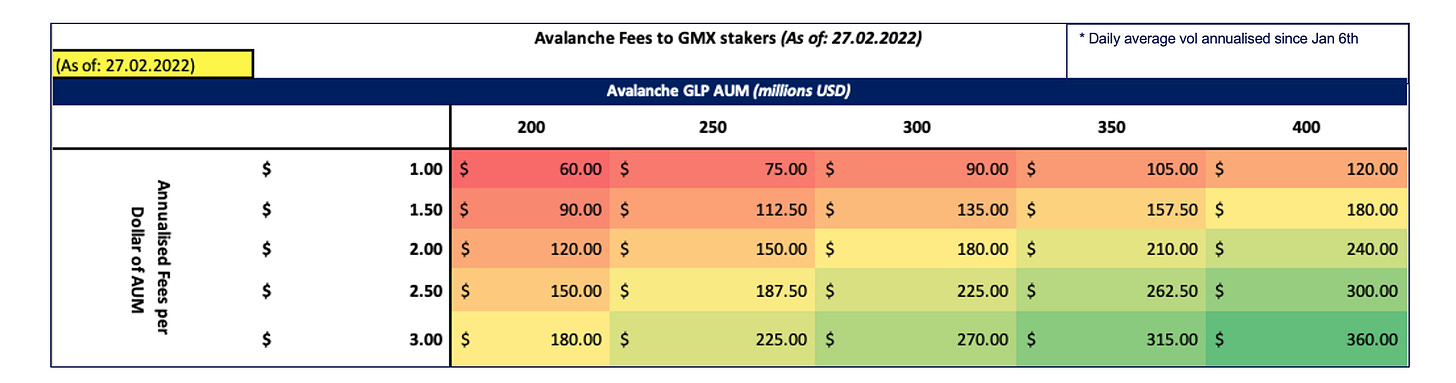

GMX is a DeFi cash cow, generating an annualised $117.2 million in protocol revenue*, which is completely distributed back to token holders. Since the 6th of January 2022, GMX has generated $10.2 million in fees on Arbitrum and $6.5 million on Avalanche (having only just launched on the 6th).

If we look at the relative market sizes of the Arbitrum network and the Avalanche network, we can can that GMX looks set to grow massively through its recent expansion to the Avalanche chain. Avalanche is currently processing 23x the daily transactions of Arbitrum and has 3.5x the TVL. However, The Arbitrum GLP currently has more liquidity, sitting at $163.5 million. It is therefore not unreasonable to think that the Avalanche GLP could grow to around $360 million (it has already gained $75 million in 52 days). If we keep the GLP average annualised fees per dollar of AUM constant ($2.33 for Arbitrum), we can model the expected fee generation from Avalanche:

We can therefore see that this chain expansion to the Avalanche network has the potential to generate massive value for GMX token holders. For example, if Avalanche could achieve a GLP AUM of $300 million and we hold the Annualised fees per dollar of AUM constant at $2.33, GMX holders would be entitled to $209.7 million. As I have modelled in the valuation section starting on page 45, this will have profound effects on the market cap of GMX.

Furthermore, this model can be extrapolated to show the effect a chain expansion can have on the market cap of GMX. I therefore believe the continued expansion of GMX to new layer 1 chains is a bullish catalyst for GMX and will result in higher fee generation and thus a higher GMX market price.

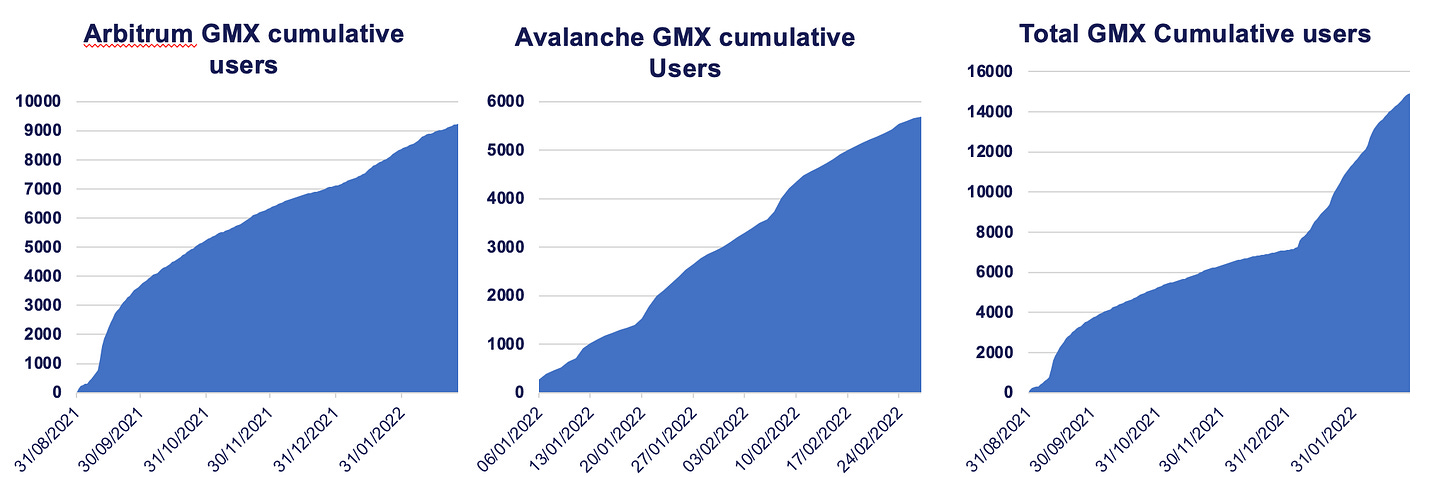

Product Market-Fit and Network Effects

Since it’s launch on the Arbitrum network at the end of August, GMX has gathered a cumulative 9,234 users and this trend shows no sign of slowing down. Even more impressive is the launch of GMX on Avalanche, with a higher user base on the underlying network, GMX has managed to reach 5,691 total users in just 52 days.

It is clear to see that in the short time GMX has been operating, it has found product-market fit as users desire an on-chain perpetual futures exchange. The plans for a GMX referral program will be a great way to increase network effects and expand vertically. Furthermore, the expansion to new chains and the integration of GMX into aggregators will ultimately lead to an increase in total users of the platform and hence, increased network effects.

Bullish Tokenomics

A large part of my investment thesis is based on the bullish token utility and tokenomics of GMX. We have already spoken about the utility through revenue generation, so I will now focus on the supply and demand aspect of the token. Firstly, GMX had what is referred to as a “fair launch” – no Venture Capital or private sales to kickstart the project. This means all holders have acquired their GMX from the open market (such as Blocktower). Thus, there are no VC’s selling tokens after purchasing in private rounds, for a fraction of the market price. Moreover, the team allocation of GMX was small, with just 250,000 GMX (1.88% of total supply), unlocked linearly over 2 years.

Supply

The total supply of GMX is 13.25 million coins, however, it is very unlikely that all of these coins will ever be circulating on the market. Firstly, the price floor fund (2 million GMX) tokens have no plan to hit the market as the team don’t want to dilute holders. Secondly, the 2 million GMX that are allocated to esGMX emissions are only liquid if token holders lock the average number of GMX or GLP tokens that earned them their esGMX for a whole year. It is therefore very likely that a large proportion of these 2 million GMX will never circulate on the open market, as people forget to vest/don’t want to. The total realistic supply for GMX is therefore much smaller than 13.25 million and makes GMX extremely scarce.

Demand

The token utility creates a large demand for GMX as 30% of protocol revenues accrue to GMX stakers. As such, 82.5% of the circulating supply is currently staked. This staked GMX is currently yielding a 27.41% APR and hence there is a high demand for the token. Token holders are further incentivised to hold through the multiplier points system and due to the clever vesting procedure of esGMX, GMX tokens cannot be farmed and instantly sold (like a number of high APR farming projects). Furthermore, the introduction of a GMX fee reduction for GMX holders will further incentivise holding a position if you are an active trader or a protocol that utilises the exchange. In a way this is similar to the Curve vetokenomics, as protocols integrating GMX will be incentivised to accumulate GMX. There are already a couple of examples of protocols acquiring GMX for their treasuries - KeeperDAO and Thorus

Community

In the digital asset space, with open source protocols, the community of a protocol plays a large role in the adoption and proliferation of that protocol. Users and investors attach ”great importance to property rights, management and project performance”, as they have a financial incentive to do so. The more users and investors they can attract to that protocol, the greater the outcome of their own investment. Therefore a strong community in crypto can act as a great marketing campaign for projects, whilst also propelling the project forward through community projects and governance proposals. In the vein, we find that the GMX community is very strong.

The community has built multiple projects to propel the GMX exchange forward, such as exchange statistics interfaces, trading competition leader boards and dashboards.

Furthermore, a community developer by the name of @xm92boi (Twitter), built a community NFT project called the GMX Blueberry Club (GBC). GBC is a generative 10,000 NFT collection o Arbitrum dedicated to the GMX decentralised exchange and its community. Since launch on the 5th of December 2021, the project has processed 535.29 ETH ($1,477,935) in volume, showing the strength of the GMX community.

Community projects:

Competition Analysis

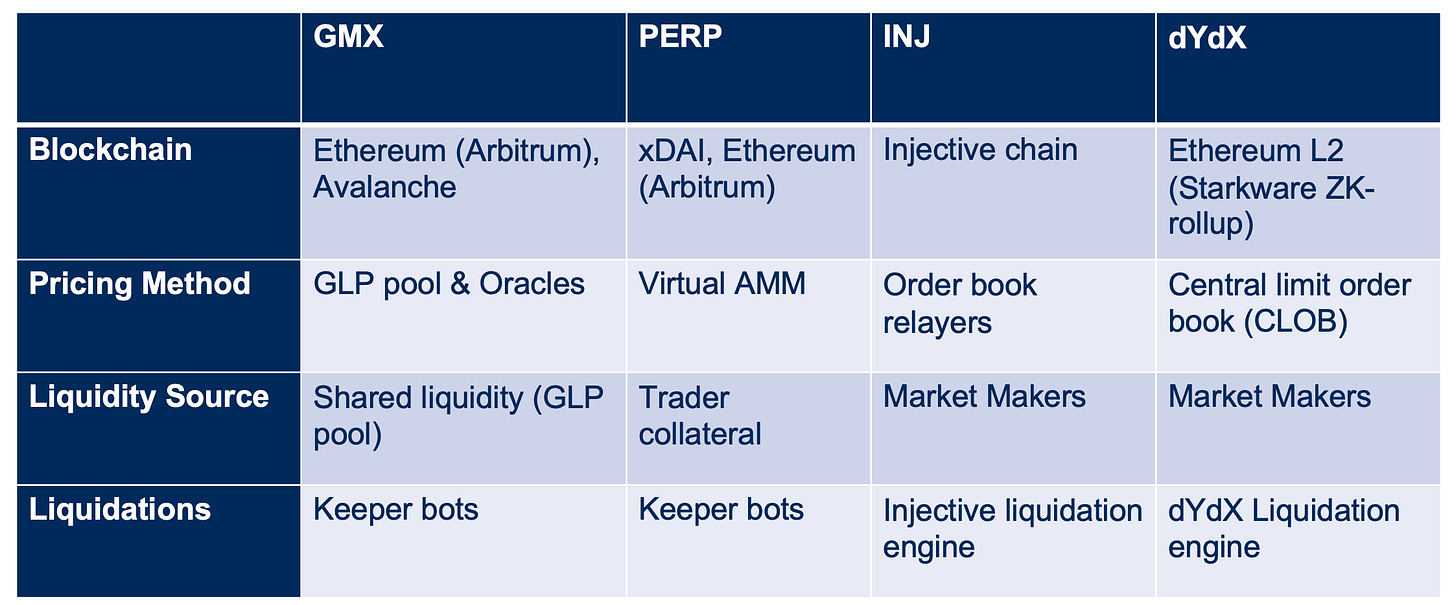

Overview

The main vertical GMX is competing in is the decentralised perpetual futures market, however, it also competes in the spot market with decentralised exchanges such as Uniswap and TraderJoe.

I believe the main vertical GMX is focused on expanding market share in is the Perp market. This is because the market opportunity here is much greater, with most of the trading in the crypto space being conducted via the perp market. The spot markets for Bitcoin and Ethereum are 7x smaller than their Perp markets ( approx $2T vs $300 billion per month).

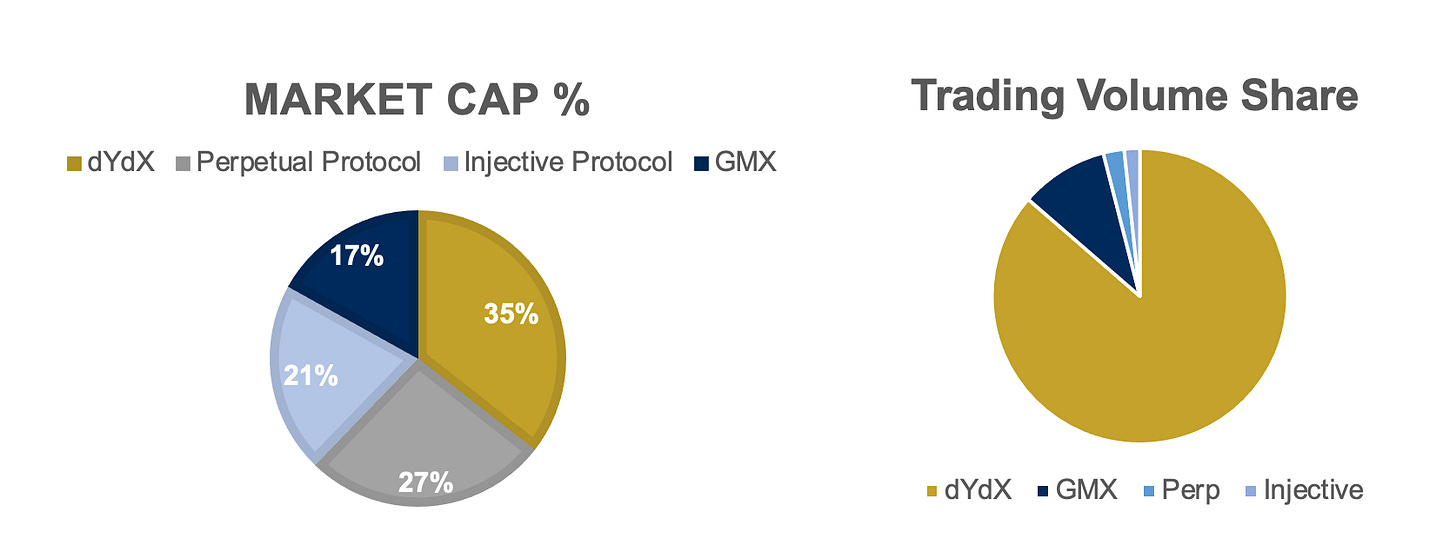

GMX is already a major competitor in this vertical, with the 4th largest circulatig market cap and the 2nd largest average daily volume (since the 1st of Jan 2022). The major competitor for GMX is dYdX, which currently processes an average of $2.18 billion per day in volume (since Jan 1st 2022), representing 86% of the trading volume between these top 4 competitors. Interestingly, GMX processes 5.6 x and 4.22 x more volume per day than Injective Protocol and Perpetual Protocol respectively, but has the smallest market cap out of the 3.

Social media Comparison

To see a full competition analysis, please check out my full research report in PDF form:

Valuation

TVL to Market Cap

The digital asset space doesn’t always trade on fundamentals and rationale and it is hard to come up with intrinsic valuations for projects. However, we can look at some relative valuation metrics to help understand the market and identify areas of relative overvaluation/undervaluation.

When analysing decentralised exchanges I believe the most important metric to look at are the volume of the protocol and its Total value locked (TVL). Comparing these metrics to the previously listed competitors, allows us to get a better sense of how GMX is valued.

Comparing the TVL to MC and FDV allows us to get a better understanding of how the market is valuing each protocol on a relative basis. If we look at MC/TVL metric we can see that dYdX and GMX are undervalued relative to the group. However, if we take FDV/TVL we we see that GMX is the most undervalued, due to the high total supply of dYdX tokens.

Notes/assumptions: GMX AVAX stats added into total, injective figures are 27 day average, comparison of TVL is not perfect as each protocol uses liquidity in a different way.

Volume to Market Cap

Another relative valuation metric that is relevant to perp exchanges is the market cap to volume multiples.

Looking at the market capitalisation-to-average daily volume we can see that both dYdX and GMX trade at relative discount to their competitors.

Looking at the MC/Vol multiples for the 7 day trailing daily average we see that dYdX is trading at 0.18x, making it the most undervalued relatively. However, once again when we take into account dYdX’s large token supply we see that GMX is trading at the largest discount when factoring in FDV.

In fact, GMX’s FDV trades at a multiple of 1.34x to its 30 day average daily volume, showing relative undervaluation without even factoring in the growth of the protocol. Furthermore, GMX trades more volume per day (average) than Perpetual protocol and Injective protocol, but has a lower market cap. This shows how relatively overvalued INJ and PERP are.

Relative Valuation

If we apply the relative multipliers from competitor protocols we can see what market cap GMX would be trading at.

Taking a look at MC/TVL, we can see that if GMX was trading at the same multiple to TVL as Perpetual protocol, its market cap would be $1.965 billion (980% higher). Furthermore, if it traded at the same multiple to TVL as Injective it would have a MC of $509 million (180% higher than today).

Moving onto relative volume valuations, we see that GMX is vastly undervalued compared to Perpetual and injective. GMX would be trading at a market cap of $966 million and $2.15 billion if it traded at the same multiple to volume as Perpetual and injective, respectively.

Price to Earnings (P/E)

GMX’s has generated a cumulative $22.1 million in fees since 31/08/21 on Arbitrum. The Annualised revenue generated from the platform fees is $56.8 million and it is all distributed to GLP and GMX holders. Dividing the fully diluted market cap by the earnings of the exchange, we can see how a protocol is valued relative to its earnings and its peers. Doing this, we can see GMX has one of the lowest P/E’s in the DeFi industry and is undervalued.

GMX has a higher P/E than dYdX, however, the actual revenue that is accrued to the token holders of dYdX is 0 and so if you were to calculate the actual P/E of the token holder for each of these projects they would be much higher, making GMX even more attractive by this metric. If we factor in how much revenue of a protocol is distributed to the holders of the token, GMX has the lowest P/E in the entire DeFi industry.

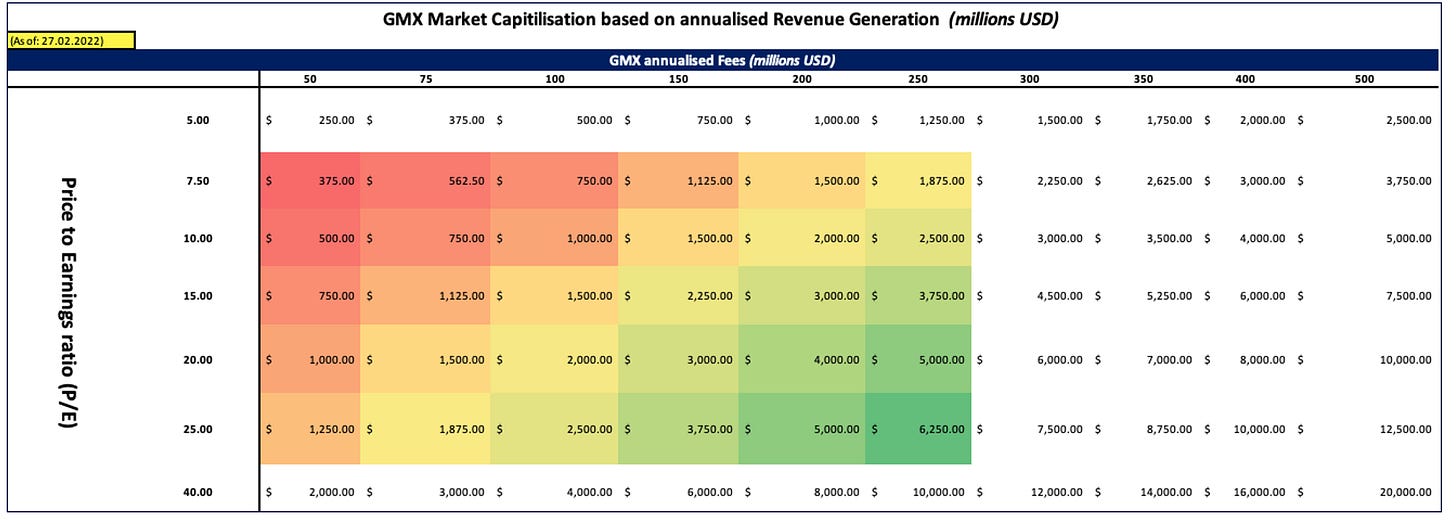

Fee generation and P/E

If we take the annualised revenue generation from the GMX protocol and multiple it by a P/E ratio, we can estimate the GMX market cap. I have taken a wide range of P/E values and GMX annualised fees, but I ultimately think the fees and P/E ratio will fall somewhere in the coloured area for 2022. If we look at the total fee generation since the 6th of Jan (when GMX launched on Avalanche), we find that the protocol has generated $16.69M in fees, or an annualised $117.2M. In fact on the 24th of Feb, GMX generated $786M in fees in just one day ($286.9M annualised).

If we assume the annualised fee generation is between $50M and $250m and the P/E ratio of the protocol is between 7.5 and 25, we get a lower bound for the GMX market cap of $375 million and an upper bound of $6.25 billion. Through the growth of GMX on Avalanche, GMX integration into aggregators and further expansion to new chains, it is likely GMX will be able to command $100-$200 million in fees.

Market Cap potential

The TAM for GMX is huge, with 2021 perpetual futures volume coming in at $57 trillion and growing by 498% in a single year. GMX is positioned well to capitalise on the growth of Perp volumes and from the transition from CEX perp trading toward DEX perp trading. It is therefore not unreasonable for GMX to reach a market cap of $2.4 billion in 2022 and $6.9 billion in 2023.

If GMX was able to achieve this market cap in 2022 it would represent a 13.25x.

This market cap analysis doesn’t even touch on GMX’s ability to facilitate spot swaps and compete with the largest DeFi protocols due to their oracle pricing system and GLP creating some of the cheapest trade routes.

Assumptions:

Total Perp volume grows by 20% per year (very conservative as they grew by 498% in 2021)

DeFi perp volume grows from around 3% to 10% of market share. (Blocktower estimate it will grow to 15% in 2022 and 20% in 2023. I have been more conservative.)

GMX market share grows to 5% of all DeFi Perp vol in 2022 and 8% in 2023

The borrow fee is not included in platform fees (this would increase protocol revenue and increase market cap estimate)

I have used total supply instead of circulating (conservative)

Risks

Long-tail asset risks – due to the oracle pricing nature of assets in the GLP pool traders can avoid market impact. This works fine for assets which are liquid such as Bitcoin or Ethereum, but for illiquid assets (long-tail assets) there are risks. Traders could potentially execute trades with no slippage on smaller cap coins.

GLP as the counterparty to traders – Since GLP is the counterparty to traders, if traders are very profitable the GLP pool is depleted. The data shows that traders are at a loss so far and GMX expect the traders to cumulatively have 0 PnL in the long-term.

Bear Market short skew – In a bear market it is likely there will be a significant short skew on open interest. Whilst the GLP pool works well in a bull market as traders are long skewed and the GLP pool will just pay out this upside to traders (whilst the assets in the GLP pool rise). However, in a bear market with traders short skewed and making money, GLP will be paying out Stablecoins to these traders as profits whilst the index assets in the GLP decrease. This would make the GLP an unattractive place to LP and we may see a decrease in the AUM. An interesting idea, akin to funding rates could solve this risk and it can be found here.

GMX team pseudonymous – The entire GMX team is pseudonymous and this makes walking away from the project/stopping shipping that much easier for the team. We are yet to see how the team works in a bear market.

Adoption risks – currently the GMX platform doesn’t allow traders to exit their position unless price has moved at least 1.5% away from their entry and this minimum price movement duration is 3 hours. This is to limit arbitrage bots taking advantage of lagged oracle price feeds, however, these features dampen the user experience. Furthermore, large players like HFT firms will not be able to use this protocol and hence adoption could be limited.

Smart contract risks – Since GMX operates on Arbitrum, an L2, it carries significant smart contract risks. Tokens within a rollup are locked into a smart contract, meaning a smart contract bug / hack could result in those funds getting stolen or frozen. However, GMX has had an audit from ABDK consulting and currently has a bug bounty listed on ImmuneFi which is a good sign.

Competition – GMX has competition from both CEXs and DEXs. Binance currently dominates the perp market and Decentralised perp exchanges only make up less than 3% of total pep volume. In the decentralised perp exchange space, dYdX currently dominates and has a significant head start on GMX.

Evaluation and Exit Strategy

GMX is a decentralised perpetual futures and spot exchange looking to fulfil the market demand for on-chain trading. Its innovative design allows it to execute trades with zero market impact, making it a very desirable place to trade. The central investment thesis is that GMX is a grassroots DeFi cash cow that distributes all trading revenue back to holders of GMX and GLP, and as such the GMX token accrues value from an increase in volume (and thus fees) on the platform.

Therefore, the question is, how will volume increase? - GMX has plans to scale both horizontally and vertically. Firstly, GMX will consolidate market share on Arbitrum and Avalanche and scale horizontally with the introduction of the trading referral program and the addition of new assets to the GLP pool. Then, GMX will increase volume by scaling horizontally; expanding to new chains, integrating as a new route in aggregators and with the launch of X4.

GMX is also positioned well to benefit from the growth in demand for perpetual futures contracts, DeFi applications and from the transition from CEX’s to DEX’s, in light of regulatory concerns.

Exit Strategy

The investment strategy for GMX would be defined by a long-term investment horizon, making up one of the key holdings in the DeFi investment theme. I would suggest staking this position to benefit from the esGMX rewards and multiplier points. If the investment is successful we would look to trim the position in 10% tranches for every 100% of returns. After a 300% return from current prices, selling 10% of the initial position at each 100% would result in a total return of 145%, with 60% of the initial position still invested. Each take profit level is labelled on the chart.

The remainder of the position will be exited based on exit catalysts and on the maturation of the project. Possible exit catalysts would include: expansion to new chains, introduction of X4 (as discussed in the roadmap section on page 22), a DeFi sub-sector bull market or a market wide bull market.

A key metric to track whilst determining the adoption and maturation of GMX would be the volume processed by the platform. Since we expect both the Perp market volume and the share that DeFi serves to grow, we will look to exit based on examining trends in this sector. By using the revenue generation model on slide 50 what the expected market cap of GMX will be dependent on the volume the platform processes (keeping P/E constant). We would therefore look to exit positions when GMX has fulfilled its potential in terms of perp market volume share.

Useful Sources: Flood Capital, DecryptVC, GMX intern, Button, DrDingus, Vikran Arum, Mark2work, 0xappodial, Xdev10, CryptoJoe, 0xMessi

If you liked my work and would like to trade Perps & Complete swaps on GMX with Zero slippage, click here:

..Exceedingly well written!! ...full ovations, from community within

great work, everything was covered.